Title: Understanding sviCAP Financial Management for Effective Wealth Management

In the realm of financial management, sviCAP stands out as a comprehensive approach to wealth management. Let's delve into what sviCAP entails, its key components, and how it can be effectively utilized for managing finances.

What is sviCAP?

sviCAP is a holistic framework for financial management that encompasses several crucial aspects:

1.

Savings

: This involves setting aside a portion of income for future needs or emergencies. Savings act as a financial cushion during unexpected events and pave the way for longterm financial stability.2.

Investment

: Investments aim to grow wealth over time through various financial instruments such as stocks, bonds, mutual funds, real estate, etc. Strategic investments can generate passive income and help achieve financial goals.3.

Capital

: Capital refers to the financial assets or resources available for investment. It includes savings, investments, and any other liquid assets that can be utilized for wealthbuilding purposes.4.

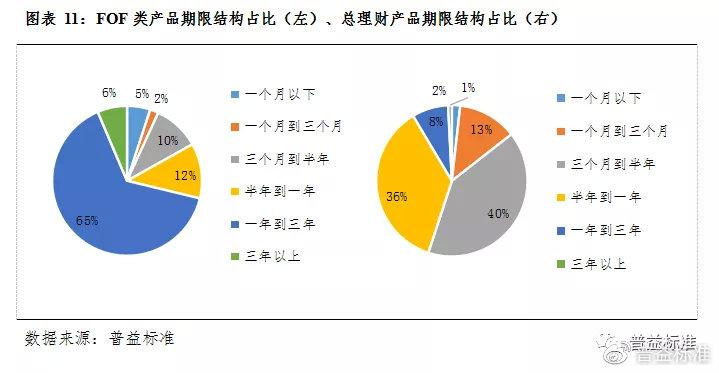

Asset Allocation

: Asset allocation involves distributing investments across different asset classes based on factors like risk tolerance, financial goals, and time horizon. Proper asset allocation is essential for optimizing returns while minimizing risk.5.

Portfolio Diversification

: Diversification is the practice of spreading investments across various assets to reduce the risk of significant losses. A welldiversified portfolio balances risk and return potential, enhancing overall stability.Key Principles of sviCAP Financial Management:

1.

Goal Setting

: Define clear and achievable financial goals, whether it's buying a house, retiring comfortably, or funding education. Goals provide direction and motivation for financial planning.2.

Budgeting

: Create a realistic budget that outlines income, expenses, savings, and investment allocations. Tracking expenses helps identify areas for saving and ensures financial discipline.3.

Risk Management

: Assess and mitigate financial risks through insurance, emergency funds, and diversification strategies. Adequate risk management safeguards wealth against unexpected events like job loss, illness, or market downturns.4.

Regular Review and Adjustment

: Review financial plans periodically to assess progress towards goals and make necessary adjustments. Economic conditions, personal circumstances, and investment performance may necessitate modifications to the financial strategy.5.

Professional Guidance

: Consider seeking advice from financial advisors or planners to develop a personalized financial roadmap aligned with individual goals and risk tolerance. Professional expertise can optimize financial decisions and navigate complex financial landscapes.Implementing sviCAP for Effective Financial Management:

1.

Assessment

: Evaluate current financial standing, including income, expenses, assets, liabilities, and risk tolerance. Understand personal financial goals and time horizons.2.

Goal Setting

: Prioritize financial objectives and set SMART goals (Specific, Measurable, Achievable, Relevant, Timebound). Break down longterm goals into smaller milestones for better tracking and motivation.3.

Budgeting and Saving

: Develop a budget that allocates income towards necessities, savings, investments, and discretionary spending. Automate savings and investment contributions to ensure consistency.4.

Investment Strategy

: Determine an investment strategy aligned with risk tolerance, financial goals, and time horizon. Consider diversifying investments across asset classes to mitigate risk and optimize returns.5.

Regular Monitoring and Adjustments

: Monitor investment performance, economic trends, and personal circumstances regularly. Rebalance the investment portfolio periodically to maintain desired asset allocation.6.

Professional Advice

: Consult with financial advisors or planners to refine financial strategies, address concerns, and optimize wealth management practices. Leverage their expertise for informed decisionmaking and peace of mind.In conclusion, sviCAP offers a structured approach to financial management, encompassing savings, investment, capital, asset allocation, and portfolio diversification. By adhering to the key principles and implementing sviCAP effectively, individuals can navigate their financial journey with confidence, achieving their longterm objectives while mitigating risks along the way.

For further guidance tailored to your specific financial situation, consider consulting with a qualified financial advisor or planner. Your financial future deserves careful planning and informed decisionmaking.